Bed And Breakfast Taxation

NSW BB operations are ideally suited to meet this expectation.

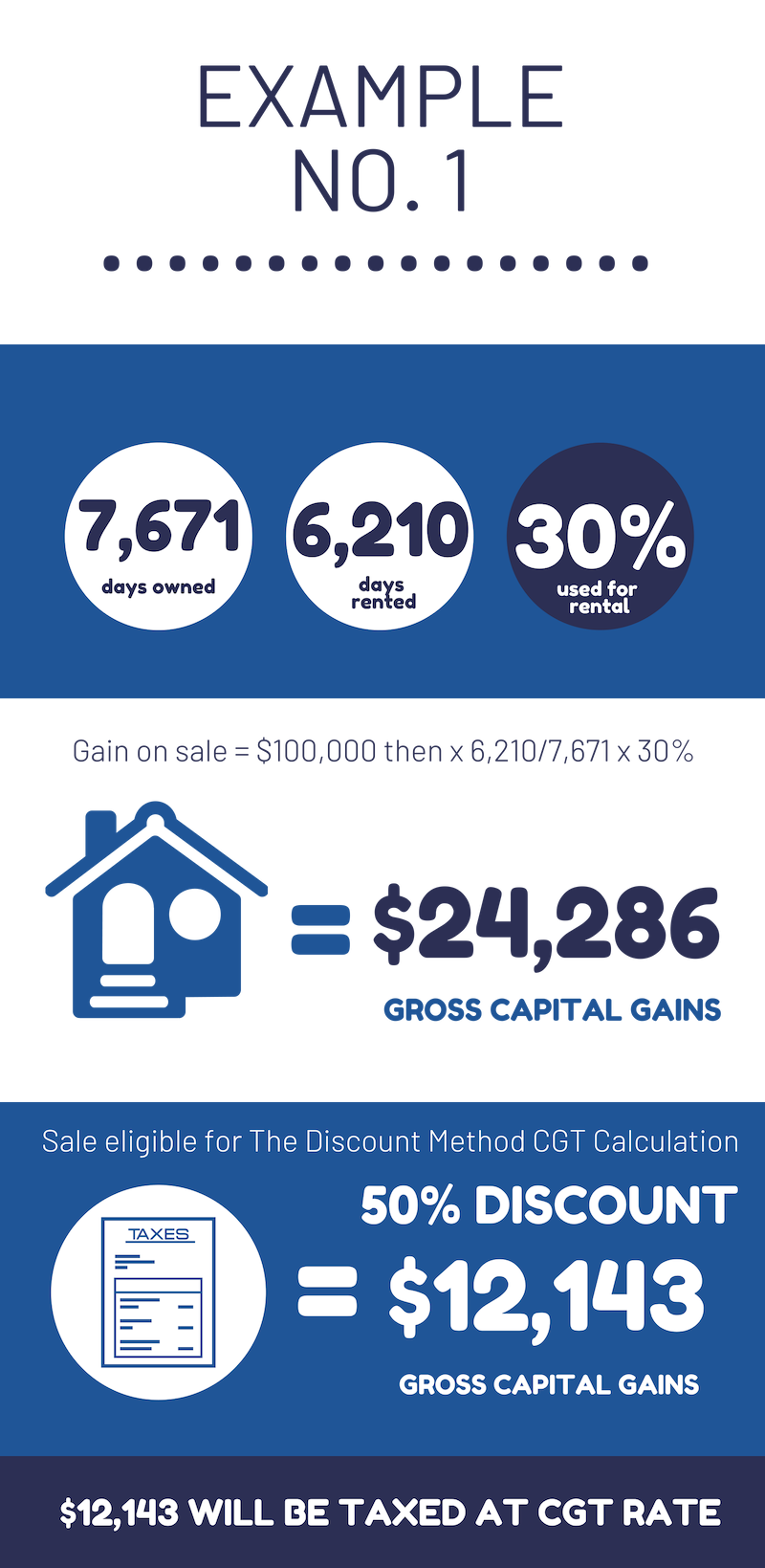

Bed and breakfast taxation. 44000 Cabin or hut operation. Depreciation on the cost of furnishings and equipment. A bed and breakfast is a small lodging establishment that usually offers only breakfast as a meal.

44000 Boarding house operation. For more information visit. This could happen for example where the loan is repaid by means of a dividend credited to the loan account which is included as income on the recipients tax.

44000 Backpacker hostel operation. This allowance means that up to a certain value 12300 in the 202021 tax year UK individuals do not pay any capital gains tax on any profit they make on disposal of assets. This means things like advertising direct food costs laundry service for the bedrooms car hire upkeep and maintenance of the rooms etc.

44000 Caravan park operation - visitor. Interest on your mortgage. Enter primary business activity business industry code or ANZSIC code.

Book Your Bed Breakfast on Airbnb Today. The rules around tax deductions for bed and breakfasts feel a little more like the home office exclusion. Airbnb has the categories Bed Breakfast tax exempt and House.

44000 Camping ground operation. If you look at HMRCs Company Taxation manual it states. The First Step To Relocate Tax Free To Italy is to subscribe to our Italian Tax Academy in order to download our free eBook.