Bed And Isa Transaction

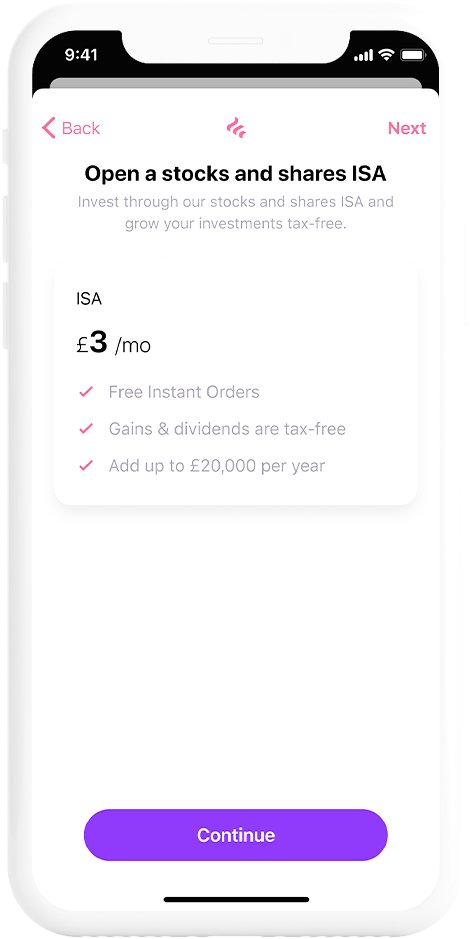

Now I completely understand that all FUTURE sales and dividend payouts for the shares in the ISA are free of CGT.

Bed and isa transaction. If you already hold an ISA and an Investment Account with us you can complete this instruction online by going to Manage Investments and then Bed ISA once logged in. The strategy can be used for CGT planning on investments that typically rise in value over the long term. Share Certificates for each holding you wish to transfer.

However to get the shares into the ISA they first had to be sold. Bed and ISA There are currently no rules against disposing of the investments you hold in your general investment account and acquiring the same investments within a tax-free Stocks and Shares ISA. Bed and Isa plans aimed at saving tax could end up costing you more in charges.

It sounds like a contradiction in terms. When can you use the bed and spouse strategy. The transactions are summarised below.

Bed and ISA transactions cannot be identified as same day or bed and breakfast transactions 3 4 Bed and breakfast or same day rules apply to all other transactions 5 Assets sharescoins are calculated assuming they fall into Section 104 holding 6 No stamp duty or any other costs are taken into calculation. Despite the name a bed and ISA doesnt have anything to with opening an ISA as you sleep. If the change has an impact on the clients financial position it indicates theres been a change in their needs or objectives and you must show why the changes you are recommending are suitable.

Sensors perception systems analyzers signal processing. The term bed and breakfasting was originally used to describe share transactions in which shares are sold one day and reacquired the following morning. Bed and ISA transactions allow you to sell existing investments and use the proceeds to open or top up an ISA account.

BED and ISA Open or top up an ISA with existing investments. BB Healthcare Trust plc announces that the undermentioned directors of the Company on 2 November sold and immediately repurchased Ordinary Shares through a Bed and ISA arrangement in order to effect the transfer of the Ordinary Shares to their respective ISA accounts. I apply to subscribe to a Shareview Dealing ISA for the tax year 201920 and each subsequent year until further notice.